Opening an Albanian Bank Account as an Expat

If you are planning to stay in Albania for more than a few months, whether you are exploring the visa free year or settling into long term life in the Balkans, a local bank account is not just convenient, it is essential. As an American who has made Albania home for over two and a half years, I have learned the ropes through first-hand experience. Here is what you need to know to open an account, reduce fees, and make everyday life a little smoother.

Why Open a Bank Account in Albania?

Opening a bank account here is a smart move, especially if you’re sticking around longer than a tourist SIM card’s expiration date. Here's why it matters:

Avoid ATM fees: Foreign cards often get charged additional bank fees from both banks.

Access better exchange rates: Albanian banks follow official rates from the Bank of Albania.

Pay rent & bills locally: Landlords, internet providers, and eAlbania transactions prefer bank transfers.

Get a local debit card: You’ll be able to shop and pay seamlessly.

Receive international payments: Whether you're freelancing or retiring, you can deposit in ALL, EUR, or USD (some banks).

Streamline your residency process: Having a local account helps validate your ties to Albania when applying for residency permits or business registration.

Enhance visa applications: Embassy officials and legal advisors often ask for proof of local financial activity.

What You’ll Need to Open an Account

Most banks follow similar steps. You’ll typically need:

A valid passport

A local address (rental contract, lease agreement, or residence permit)

A local Albanian phone number

A small initial deposit (usually 1,000–2,000 ALL)

Optional: Proof of income or U.S. tax ID, depending on the bank

Once you're approved, most banks issue debit cards within 5–10 business days, upon request. Online and mobile banking may be available, especially in larger banks.

Banks That Are Friendly to Foreigners

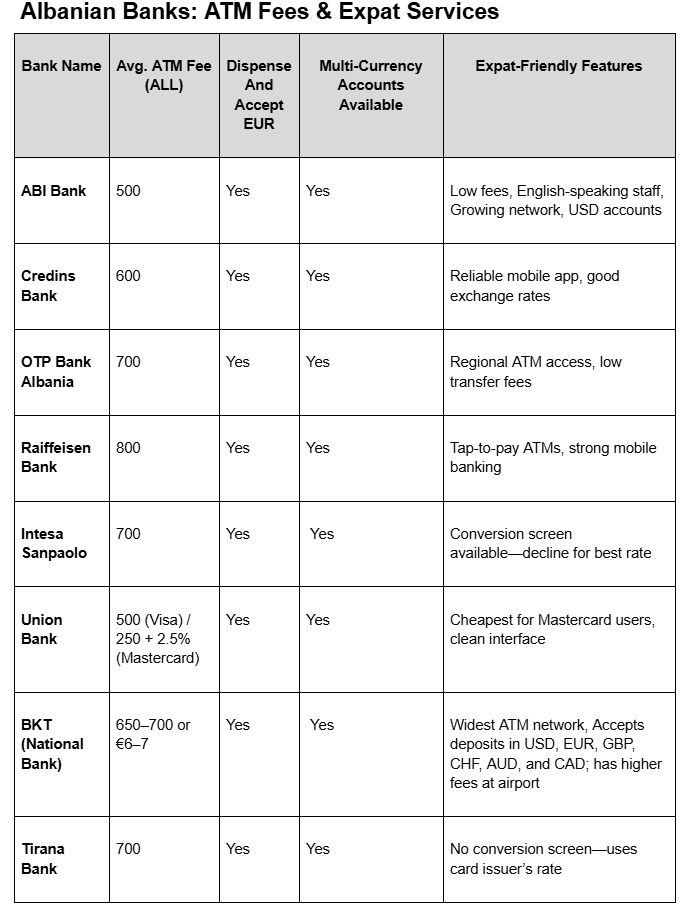

Here’s a breakdown of banks with strong expat support, low fees, and multi-currency options:

When opening a USD account, remember to ask about:

Minimum deposit requirements

Interest rates on term deposits

Currency conversion fees

Online banking access in English

Tips for Using ATMs in Albania

Always decline conversion when prompted to avoid hidden markups.

Use Union Bank (Mastercard) or ABI Bank for the lowest flat fees.

Avoid ATMs at the airport unless necessary. They charge the highest fees.

ATMs at Taiwan Center, Twin Towers, and Rruga Ismail Qemali are known to dispense euros as well as lek.

Bring a multi-currency debit card if possible for added flexibility.

No matter how long you’re staying in Albania, having a local bank account can make life easier, cheaper, and transactions more seamless. From avoiding surprise ATM fees to building proof of residency, your account becomes more than a place to stash cash, it’s a gateway to belonging in your new community.